32+ Lump payment mortgage calculator

Enter your filing status income deductions and credits and we will estimate your total taxes. Adjust your next offer according to the debt collectors counteroffer.

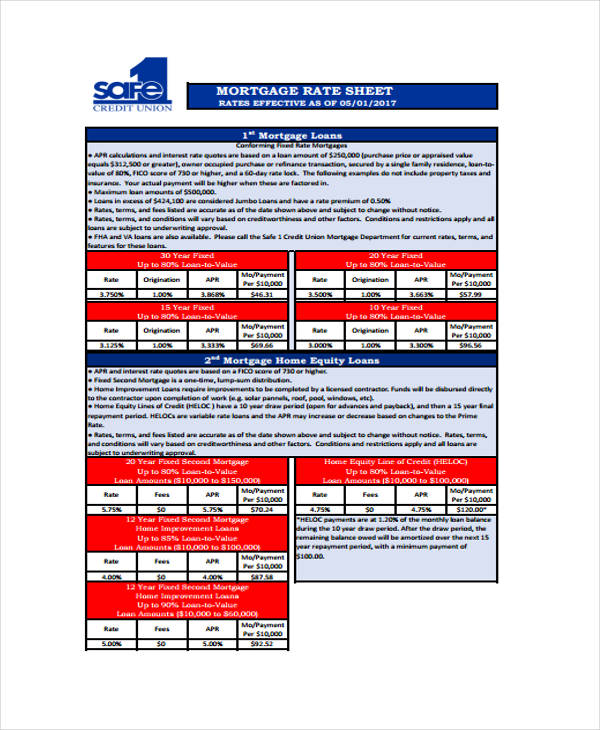

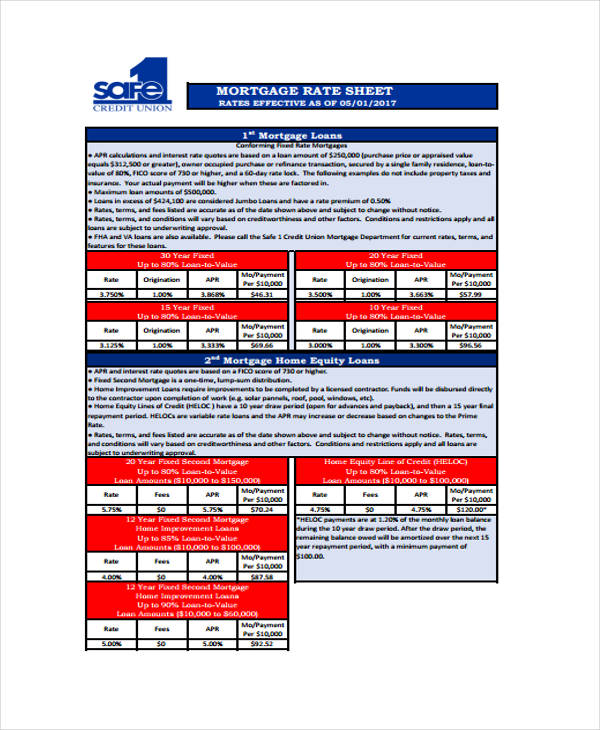

44 Sheet Examples Psd Ai Word Pdf Free Premium Templates

The payment is based on a traditional amortization schedule such as a 30-year.

. Lenders then add any. Second mortgage types Lump sum. In that case you can use our extra payment mortgage calculator which has options to include extra payments on your land loan.

Mortgage protection insurance is matched up to the mortgage balance and the money will go only toward that. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. Our advanced mortgage payment.

If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal. We also generate graphs summaries of balances payments and interest over the life of your mortgage. Get the latest financial news headlines and analysis from CBS MoneyWatch.

Dont enter more than the underpayment amount on line 1a for each column see instructions. Mortgage Brokerage Licence 12728. Please note this calculator is for the 2022 tax year which is due in April 17 2023.

Thanks for letting me know. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Some conventional lenders will accept down payments as low as 3 but youll most likely need to purchase private mortgage insurance PMI to secure the loan.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Payment Due Dates a 041521 b 061521 c 091521 d 011522. Loan amount 245000 15 year term Annual payment of 25000 towards the principal Interest rate of 2671.

Though the interest rate typically drops only a fraction of a percentage per point this difference can be felt in each monthly payment as well as the total amount you eventually pay. Underneath the sub menu My payments choose the make a payment Overpayment missed mortgage payment or manual mortgage payment option and select lump sum overpayment. You may also enter extra lump sum and pre-payment amounts.

So for a 100000 mortgage youd need a down payment of 20000 excluding closing costs and taxes. Virgin Money Australia Pty Limited ABN 75 103 478 897 promotes and distributes the companion account and the home loans as the authorised representative and credit representative of the issuer and credit provider Bank of Queensland Limited ABN 32 009 656 740 Australian Credit. Some landowners may want to pay off their loans faster they can make extra payments to pay down the principal on a monthly basis or make a one time lump sum payment.

Thank you for providing this resource. Get 247 customer support help when you place a homework help service order with us. Using the Extra Payment Calculator Im able to put in a 25000 annual payment towards the loan but not an extra 200 per month also.

Information is current as at 1 September 2022 and is subject to change. This is called a balloon payment where you pay the total remaining balance by the end of the agreed term. Using our calculator above you can estimate the savings difference conveniently.

With each subsequent payment you pay more toward your balance. This calculator can also help you decide if transferring the 10000 in debt to a 0 APR balance transfer credit card would save you money. Must contain at least 4 different symbols.

Trying to see an amortization schedule with these numbers. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Start by proposing a reasonable lump-sum payment but not the maximum amount you can afford.

Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. A borrower can make a one-time lump sum payment or increase his monthly payment. Mortgage calculator with extra payments lump-sum or multiple extra payments.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Date and amount of each payment applied to the underpayment in the same column. When you use this service youll see all the information you need including your remaining annual allowance if you have a fixed interest rate.

2019 at 632 am No problem. 6 to 30 characters long. 30-Year Fixed-Rate Mortgage Loan Amount.

By increasing the monthly payment you pay off your mortgage faster and cut down on interest payments. Land Payment Calculator with Extra Payments. Lenders typically require a down payment of at least 20.

Private mortgage insurance PMI you made a 20 down payment worth 65000. Second mortgages come in two main forms home equity loans and home equity lines of credit. The calculator below also accounts for other homeownership costs such as real estate taxes homeowners insurance and HOA fees.

The loan is secured on the borrowers property through a process. Which lenders require you to purchase if you make a down payment of 20 or less. Enter additional payments view graphs calculate interest and mortgage payments.

1040 Tax Estimation Calculator for 2022 Taxes. The Ultimate Mortgage Calculator calculates mortgage payment amount term down payment or interest rate creates payment plan with dates points and more. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. A lender asks a borrower to pay the full loan after several years with a lump sum payment.

Use this simple online mortgage calculator to easily estimate your monthly mortgage payment interest rates and taxes. Enter your underpayment from Part III Section A line 17. Takes the guesswork out of paying off a mortgage Receiving a lump sum of money from a traditional term policy can be overwhelming.

ASCII characters only characters found on a standard US keyboard. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest.

For instance a commercial loan has a balloon payment due in 10 years. The following table compares costs between monthly mortgage. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

A down payment is a percentage of the value of the home that is made upfront in a lump-sum. A borrower also benefits from purchasing discount points by lowering their applied interest rate over time.

Infographic How Can You Use Home Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

Home Loans At Attractive Interest Rates From Hdfc Home Loans Best House Loan Interest Rates For Women And Salaried Individual Home Loans Loan Loan Application

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortga Mortgage Loan Originator Mortgage Loans Private Mortgage Insurance

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

How Much Term Life Insurance Cover Do I Need Online Insurance Coverage Calculator Term Life Life Insurance Policy Life Insurance Calculator

Effective Interest Rate Formula Excel Free Calculator In 2022 Excel Formula Effective

Home Reversion Complete Mortgages Home Novelty Sign Mortgage

Personal Loan Emicalculator Use Our Personal Loan Emi Calculator To Calculate Your Monthly Emi For Personal Loans From H Personal Loans Loan Loan Calculator

Budget Calculator Budget Planner Mls Mortgage Budget Calculator Budgeting Amortization Schedule

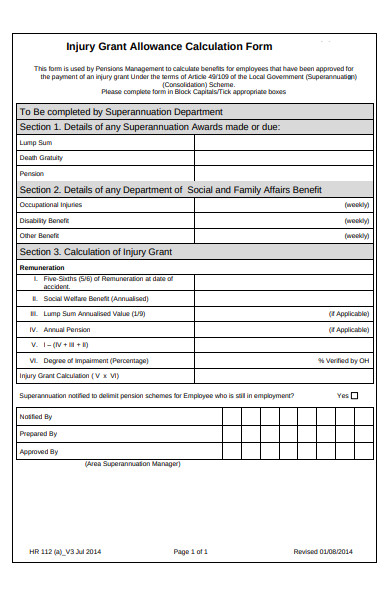

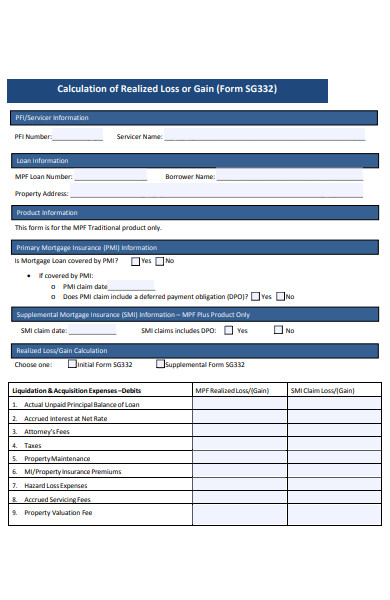

Free 31 Calculation Forms In Pdf Ms Word

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

How To Save 500 A Month Challenge Money Saving Strategies Money Challenge Save Money Fast

Free 31 Calculation Forms In Pdf Ms Word

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Dave Ramseys 7 Baby Steps Are A Great Way To Organize Your Finances And Get Started On Your Pa Money Management Advice Money Saving Strategies Financial Budget

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Loan Payoff Debt Calculator Student Loans

Loan Payment Spreadsheet Budget Spreadsheet Spreadsheet Mortgage Amortization Calculator